Did you know your CPAP supplies could be yours for $0?

You heard me right—your insurance could pay for your sleep therapy equipment!

However, one of the most common complaints I’ve heard among CPAP users is how difficult it is to work with insurance to get CPAP supplies covered. There’s always a long process of checking your policy, going back and forth with your insurance rep about what should be covered, and then after finally getting your supplies, you have to hope that the insurance company doesn’t change their mind about coverage and send you the bill later.

Well, worry no more! Easy Breathe heard your concerns and made the process much simpler with our new Insurance Checker. So, whether you’re looking to replenish your CPAP supplies or have your insurance cover an upgrade to ResMed’s AirSense 10 AutoSet C2C (our best-selling “Smart” CPAP), Easy Breathe is here to help.

What is Easy Breathe’s Insurance Check?

The Easy Breathe Insurance Check allows you to check your insurance coverage super easily for a CPAP/BiPAP and supplies. To top it off, Easy Breathe guarantees your price at checkout, and will never balance bill you if your insurance is no longer able to cover their part.

This is a great option for you if you…

- Don’t like your current CPAP and want to know if you’re eligible to upgrade

- Don’t want to waste time talking to your insurance company

- Don’t want to worry about being balance-billed after placing your order

What do you have to do?

All you need to do is fill out a simple form online to get your benefits checked easily and quickly.

No need for a long call with your insurance company or your doctor!

To request a free, no-obligation insurance verification, all you need to do is:

What does Easy Breathe do for me?

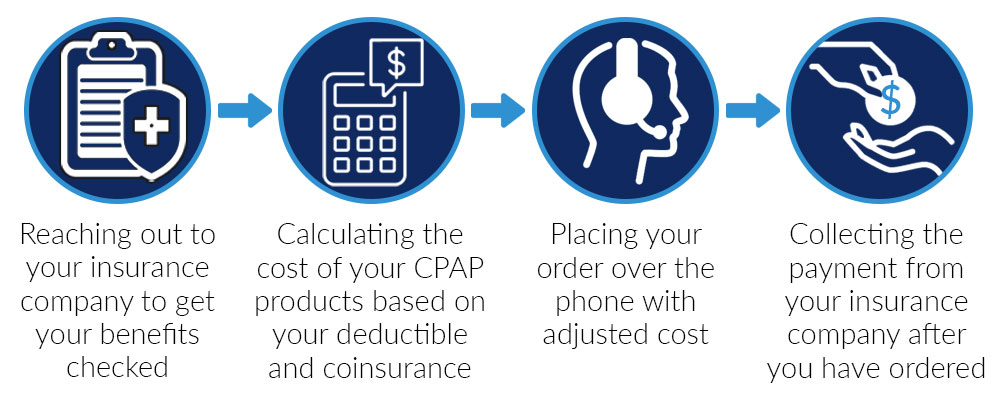

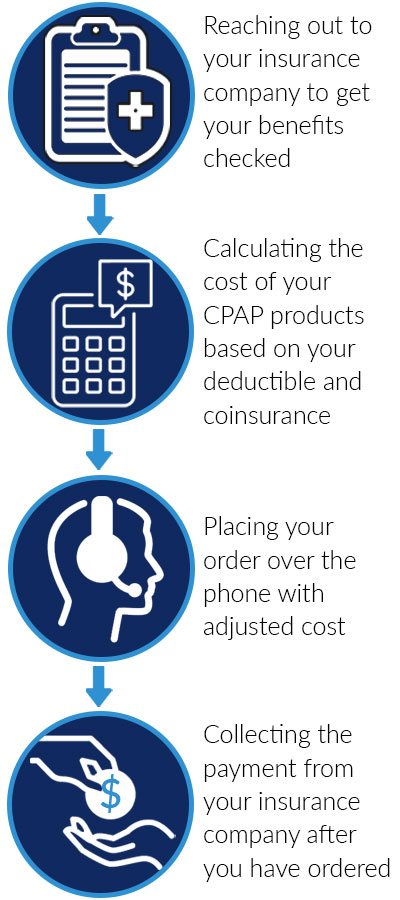

After submitting your benefits, Easy Breathe will do all of the work for you! That includes:

What CPAP supplies are covered by my insurance?

Many CPAP users aren’t aware that their insurance company will cover both a new machine and other CPAP supplies on a regular replacement schedule. Here’s what you might be eligible for:

- CPAP/BiPAP Machine: eligible every 5 years

- Mask Headgear and Humidifier Chamber: eligible every 6 months

- Mask Frame and Tube: eligible every 3 months

- Mask Cushion and Machine Filter: eligible every 2 weeks

Now that you know your new CPAP could be covered, is it time to finally upgrade to a new machine (courtesy of your insurance, of course)?

Submit your insurance information so we can help you upgrade to the newest CPAP on the market, Resmed’s AirSense 10 AutoSet C2C CPAP. The AirSense’s unique features make it the smartest, most intuitive CPAP on the market.

- Auto-titration: automatically adjusts the pressure setting based on your unique needs

- Whisper-quiet technology: makes for the most peaceful sleeping environment for you and your bed partner

- Advanced comfort settings: personalizable settings tailored to you to make breathing easy and more comfortable