Did you know your CPAP supplies could be yours for $0?

You heard me right—your insurance could pay for your sleep therapy equipment!

As the new year begins, it’s a great time to take a closer look at your CPAP therapy needs and your insurance coverage. With most deductibles resetting on January 1st, understanding your benefits could save you significant money on CPAP supplies.

Whether you’re due for replacement parts, need new accessories, or are considering upgrading your equipment, a quick check of your insurance plan can ensure you’re maximizing your benefits and staying compliant with your therapy. Don’t let 2025 catch you off guard—here’s how to make the most of your coverage.

What is Easy Breathe’s Insurance Check?

The Easy Breathe Insurance Check allows you to check your insurance coverage super easily for a CPAP/BiPAP and supplies. To top it off, Easy Breathe guarantees your price at checkout, and will never balance bill you if your insurance is no longer able to cover their part.

This is a great option for you if you…

- Don’t like your current CPAP and want to know if you’re eligible to upgrade

- Don’t want to waste time talking to your insurance company

- Don’t want to worry about being balance-billed after placing your order

What do you have to do?

All you need to do is fill out a simple form online to get your benefits checked easily and quickly.

No need for a long call with your insurance company or your doctor!

To request a free, no-obligation insurance verification, all you need to do is:

- Click the Check Your Insurance Coverage button to find the Insurance Check form.

- Fill out and submit the form with your information. You will need your insurance card.

- Easy Breathe will reach out to you after checking your policy! Be sure to check your email and/or phone voicemail.

- CPAP/BiPAP Machine: eligible every 5 years

- Mask Headgear and Humidifier Chamber: eligible every 6 months

- Mask Frame and Tube: eligible every 3 months

- Mask Cushion and Machine Filter: eligible every 2 weeks

- Auto-titration: Automatically adjusts the pressure setting based on your unique needs

- Whisper-quiet technology: Makes for the most peaceful sleeping environment for you and your bed partner

- Advanced comfort settings: Personalized settings tailored to you to make breathing easy and more comfortable

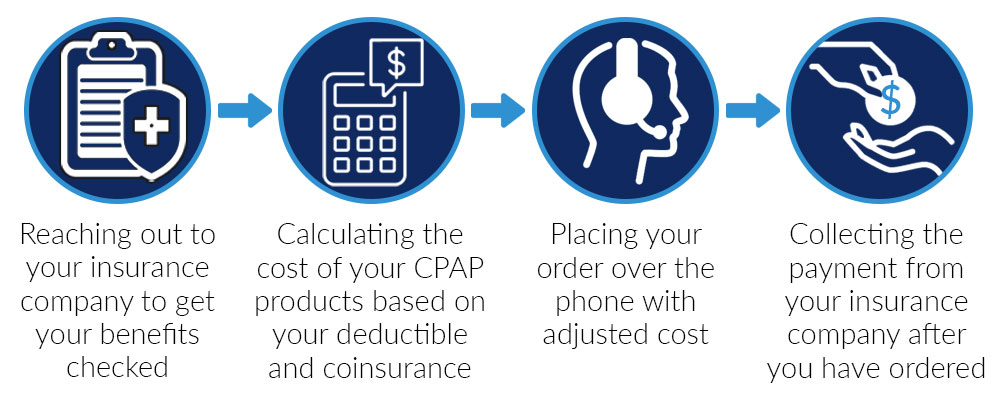

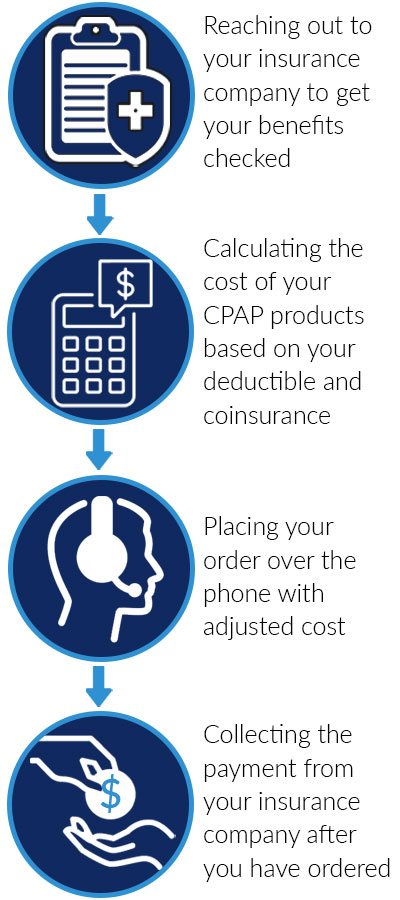

What does Easy Breathe do for you?

After submitting your benefits, Easy Breathe will do all of the work for you! That includes:

What CPAP supplies are covered by your insurance?

Many CPAP users aren’t aware that their insurance company will cover both a new machine and other CPAP supplies on a regular replacement schedule. Here’s what you might be eligible for:

Now that you know your new CPAP could be covered, is it time to finally upgrade to a new machine (courtesy of your insurance, of course)?

Submit your insurance information so we can help you upgrade to the newest CPAP on the market, ResMed’s AirSense 11 Auto CPAP. The AirSense’s unique features make it the smartest, most intuitive CPAP on the market.